Two examples of how the 50 and 200 EMA could be used are Ģ: To spot a mean reversion or trend growing momentum. This can tell you a lot about what price is doing and where it could be heading. Whilst the 200 moving average is a longer term indicator, the 50 period will remain a lot closer to the price action. The reason for using two moving averages, one a longer period than the other is because the shorter period moving average will react more quickly to what price is doing. The most popular and widely used combination is the 200 and 50 moving average. Using them both together will give a higher probability trade and higher confirmation.Īs the chart shows below both the support level and 200 EMA line up to give a possible long trade entry.Ī very popular way to use the 200 period moving average is with another smaller period moving average. You can also use it with your trendlines. The other way that dynamic support and resistance can be used is in conjunction with standard support and resistance. Price continually tests the 200 moving average, but each time this level holds as a dynamic resistance level and potential area to enter short trades. One of the other main strategies used with the 200 period moving average is trading the ‘bounces’ off dynamic support and resistance.ĭynamic support and resistance is simply support and resistance that is changing as price is moving higher or lower.Īs the first chart shows below price is in a clear trend lower with the 200 EMA making a solid downward slant. Price also makes tests at breaking through higher, but can’t and continues to move with the trend.Įventually the move and trend lower ends and this is signified by the 200 moving average being broken and price beginning a trend back higher. To use the 200 EMA for trend trading we are waiting for a clear direction either higher or lower.Īs the chart shows below the 200 EMA begins to move clearly lower. This also means we are looking for larger pip targets with larger stop losses. When trend trading with the 200 moving average we are looking for large running trends. There are two main strategies that are normally used to find trades with the 200 EMA.

Keep in mind this is a longer term indicator set over 200 periods that is best used to find longer term trends. This way you can either find new long running trend trades, or exit with healthy profits.

The main strategy when using the 200 EMA is identifying larger trends or looking for when trends are changing. You can also use it on all time frames and markets. It has a lot of benefits and applications that you could potentially use it in your trading for. The 200 EMA trading strategy is incredibly simple and easy to use. NOTE:If you do not yet have the correct charts make sure you read about the best trading charts and the broker to use the moving average trading strategy with here. Then, click okay and the moving average will be applied to your chart.

To start using the 200 EMA select “200” under the period and “Exponential” under the MA Method boxes. Once you have done this a box will open up on your chart and you will be presented with some options.

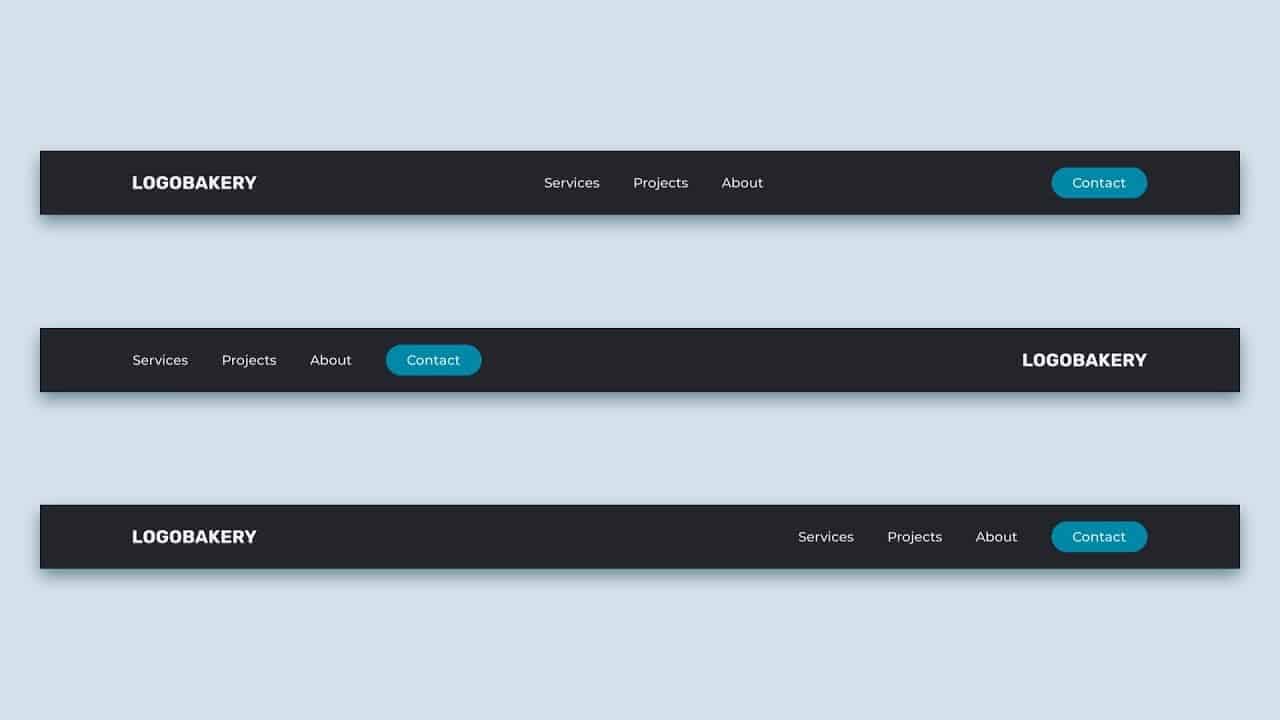

#Simple css navigation bar how to

How to Use the 200 EMA Indicator on MT4 and MT5 For example if using it on a 15 minute chart, then the 200 EMA will be using the last 200 periods from the 15 minute time frame. You can use this on any time frame to find trends or dynamic support and resistance. The 200 period EMA is using the last 200 periods of information to create a moving average on your chart. Where a simple moving average averages the price data equally for all periods, the exponential moving average has more emphasis on the recent price. The main difference between these two types of moving averages is that the exponential moving average gives more weight to the recent price. There are two popular forms of moving averages that are used. For example a 200 day moving average is using the last 200 days price information. The moving average is created by showing the average price over a set period of candles or time. It can also help you find dynamic support and resistance. The moving average is an indicator that smooths out the price action’s moves and helps you find clear trends.

0 kommentar(er)

0 kommentar(er)